The Ministry of Finance has issued a statement addressing the spread of misleading information regarding the new tax regime on certain social media platforms. The Ministry clarified that there are no new changes coming into effect from April 1, 2024.

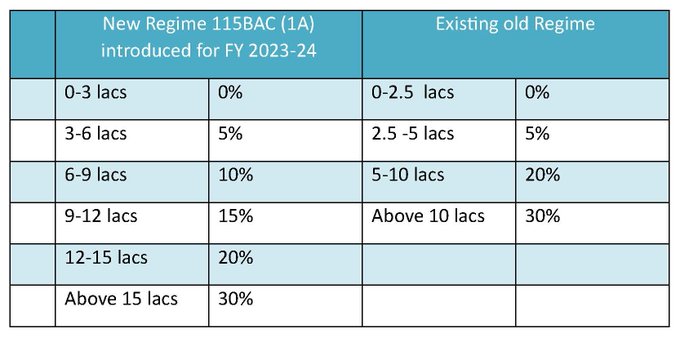

The new tax regime under section 115BAC(1A), introduced in the Finance Act 2023, applies to individuals and entities other than companies and firms as a default regime from the Financial Year 2023-24, with the corresponding Assessment Year being 2024-25.

While the new tax regime offers significantly lower tax rates, it does not provide benefits of various exemptions and deductions, except for standard deductions. Taxpayers have the option to choose between the old and new tax regimes based on their preference.

Furthermore, taxpayers can opt out of the new tax regime until filing their returns for the Assessment Year 2024-25. Eligible individuals without business income have the flexibility to select the regime on a yearly basis.